Bitcoin, the world’s leading cryptocurrency, operates independently of traditional financial systems, but it is not immune to macroeconomic factors like the U.S. Federal Reserve’s monetary policy. Changes in Fed policy, particularly interest rate decisions, can influence the price of Bitcoin and other cryptocurrencies. While Bitcoin is often seen as a decentralized asset, the economic environment created by Fed policies plays a significant role in shaping its market dynamics.

In this article, we’ll explore the relationship between Fed policy and Bitcoin’s price movements, focusing on how interest rate changes and monetary policy decisions impact the value of this leading cryptocurrency.

Understanding Bitcoin and Fed Policy

Bitcoin was designed as a decentralized digital currency, free from government control and central bank intervention. It operates on blockchain technology and is driven by market forces like supply, demand, and investor sentiment. However, despite its independence, Bitcoin’s price is still influenced by broader economic conditions, particularly those shaped by the Federal Reserve.

The Fed’s decisions on interest rates, inflation control, and economic stability can have a ripple effect across financial markets, including the crypto space. As an alternative asset, Bitcoin often reacts to changes in investor confidence, liquidity, and risk appetite, all of which are influenced by Fed policy.

How Fed Interest Rate Changes Affect Bitcoin

Interest rate changes by the Federal Reserve are one of the most direct ways its policies impact Bitcoin prices. When the Fed raises or lowers interest rates, it affects the broader financial environment, influencing asset allocation and investor behavior.

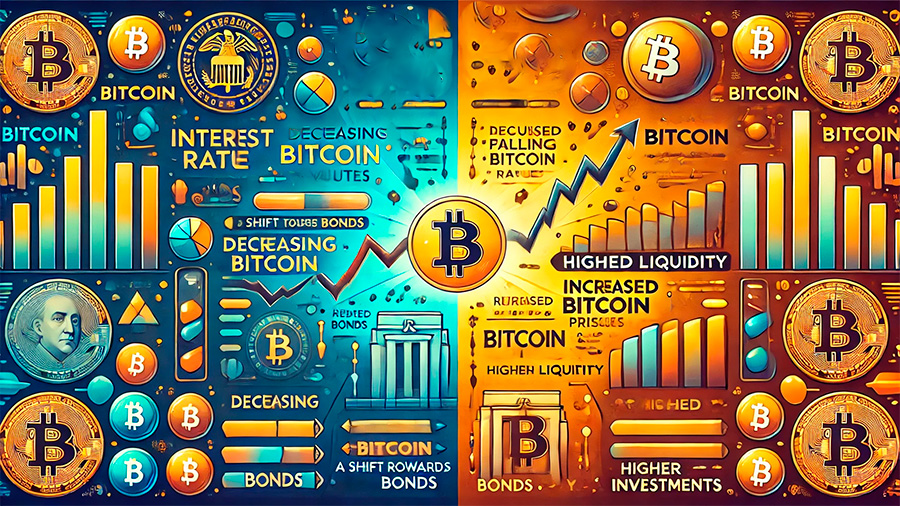

Rising interest rates: When the Fed raises interest rates, it becomes more expensive to borrow money, and this typically leads to reduced liquidity in the financial system. As a result, investors tend to shift away from riskier assets like Bitcoin and cryptocurrencies, opting instead for safer investments like bonds or cash. Rising rates also make it more expensive to borrow money for speculative investments, which can reduce demand for Bitcoin and lead to lower prices.

Falling interest rates: Conversely, when the Fed lowers interest rates, borrowing becomes cheaper, and there’s an increase in market liquidity. This environment often encourages investors to take on more risk, which can benefit Bitcoin. In times of low interest rates, Bitcoin is viewed by some as a hedge against inflation, especially when traditional savings accounts offer little to no yield. The increased demand for alternative assets like Bitcoin during periods of low interest rates can drive prices higher.

Bitcoin as a Hedge Against Inflation

Another critical aspect of the relationship between Fed policy and Bitcoin’s price movements is inflation. The Federal Reserve uses interest rate adjustments to control inflation. When inflation rises too quickly, the Fed typically raises rates to cool off the economy and prevent prices from spiraling out of control.

Bitcoin is often viewed as a hedge against inflation, similar to gold. When inflation is high and the value of fiat currency decreases, investors look for alternative assets that retain value. Bitcoin, with its fixed supply of 21 million coins, is seen by some as a store of value that is immune to inflationary pressures.

During periods of high inflation, when the Fed’s policies are perceived as insufficient to curb rising prices, Bitcoin tends to attract more attention from investors looking to protect their wealth. This increased demand can lead to higher Bitcoin prices, particularly during periods of economic uncertainty.

Market Liquidity and Bitcoin Volatility

The liquidity in financial markets, which is heavily influenced by the Fed’s monetary policy, also plays a significant role in Bitcoin’s price movements. When the Fed injects liquidity into the economy through quantitative easing (buying bonds and other financial assets), it increases the amount of money circulating in the market. This environment encourages investment in riskier assets, including Bitcoin, as investors seek higher returns.

On the flip side, when the Fed tightens monetary policy by raising rates or tapering asset purchases, liquidity dries up, and there is less capital available for speculative investments. This often leads to reduced interest in Bitcoin, contributing to increased volatility and price drops.

Correlation with Traditional Markets

Bitcoin has historically been viewed as a non-correlated asset, meaning its price movements were thought to be independent of traditional financial markets like stocks or bonds. However, recent trends suggest that Bitcoin’s correlation with traditional assets may increase during periods of economic stress or uncertainty.

For example, during major economic events or stock market sell-offs driven by Fed rate hikes, Bitcoin’s price has often mirrored the broader market decline as investors seek to reduce risk. This suggests that while Bitcoin may be an alternative asset, it is not entirely isolated from the effects of traditional market dynamics, especially when driven by changes in Fed policy.

Investor Sentiment and Bitcoin Prices

Investor sentiment plays a crucial role in Bitcoin’s price movements, and this sentiment is influenced by Fed policy decisions. When the Fed signals that it will keep interest rates low or engage in policies that support economic growth, investors generally feel more confident about taking risks. This increased confidence can drive more money into speculative assets like Bitcoin.

On the other hand, when the Fed signals a more hawkish stance—raising rates to combat inflation or slowing down economic growth—investors may become more risk-averse, pulling money out of volatile assets like Bitcoin. This shift in sentiment can lead to sharp declines in Bitcoin’s price, particularly when combined with broader market sell-offs.

Bitcoin’s Role in a Diversified Portfolio

For investors looking to hedge against the effects of Fed policy changes, Bitcoin can serve as part of a diversified portfolio. While Bitcoin is volatile, it offers the potential for significant returns, especially during periods of economic instability when traditional assets may struggle. Some investors use Bitcoin as a hedge against currency devaluation, inflation, and other economic risks, which can be influenced by the Fed’s monetary policy.

However, due to its volatility, Bitcoin should be treated as a small portion of a broader investment strategy, balanced with more stable assets like bonds, stocks, or commodities. This approach helps mitigate risk while still allowing investors to capitalize on Bitcoin’s growth potential.

Conclusion

The relationship between Fed policy and Bitcoin’s price movements is complex but undeniable. Changes in interest rates, inflation control measures, and liquidity management all play a role in shaping the value of Bitcoin. While Bitcoin operates outside the traditional financial system, it is still influenced by broader economic conditions, making it essential for investors to understand how Fed policy impacts its price.

By staying informed about the Fed’s monetary decisions and understanding how these policies affect Bitcoin, investors can make more informed choices about when and how to invest in the cryptocurrency market.