Asset allocation is a fundamental strategy for building a strong and resilient investment portfolio. By diversifying your investments across different asset classes, such as stocks, bonds, and cash, you can manage risk more effectively and improve your portfolio’s ability to withstand market fluctuations. The right asset allocation strategy balances risk and reward, aligning with your financial goals, time horizon, and risk tolerance.

In this article, we’ll explore how to use asset allocation to create a balanced and resilient investment portfolio that can weather market volatility and deliver long-term success.

What Is Asset Allocation?

Asset allocation refers to the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash, based on your financial goals and risk tolerance. The goal of asset allocation is to diversify your investments to reduce risk while maximizing potential returns. Each asset class performs differently under various market conditions, so spreading your investments across multiple asset classes helps ensure that your portfolio can weather both market upswings and downturns.

For example, when stocks experience a downturn, bonds may hold their value or even increase, helping balance out the overall performance of your portfolio. By allocating assets strategically, you can mitigate the impact of market volatility and achieve more stable returns over time.

Step 1: Assess Your Risk Tolerance and Financial Goals

Before you can determine the right asset allocation for your portfolio, it’s essential to assess your risk tolerance and clarify your financial goals. Your risk tolerance refers to how much risk you’re comfortable taking on in pursuit of potential returns. If you’re willing to accept more risk for the chance of higher rewards, you may lean toward a more aggressive asset allocation. Conversely, if you prefer stability and want to protect your capital, a conservative allocation may be more appropriate.

Your financial goals will also play a critical role in determining your asset allocation. For example, if you’re investing for a long-term goal like retirement, you may be able to take on more risk because you have time to recover from short-term losses. If your goal is shorter-term, like saving for a home, you’ll want to focus on preserving capital, which means choosing safer, lower-risk assets.

Understanding Time Horizons

Your investment time horizon is another key factor in asset allocation. A longer time horizon allows for more aggressive investments, such as stocks, which offer higher growth potential but come with greater short-term volatility. On the other hand, if you need to access your money within a few years, it’s better to allocate more toward stable, income-generating assets like bonds or cash.

For example:

Long-term goals (10+ years): A higher allocation to stocks may be appropriate since you have time to recover from market volatility.

Medium-term goals (3-10 years): A more balanced allocation of stocks and bonds provides growth potential while offering some stability.

Short-term goals (less than 3 years): A conservative allocation focused on bonds and cash will help preserve your capital.

Step 2: Diversify Across Multiple Asset Classes

Diversification is at the heart of asset allocation. By spreading your investments across different asset classes, you reduce the risk that poor performance in one area will have a significant negative impact on your entire portfolio. Each asset class has its own risk and return characteristics, and they tend to perform differently depending on economic conditions.

Here’s a breakdown of the major asset classes to include in your portfolio:

Stocks: Equities represent ownership in companies and have historically provided the highest returns over time. However, stocks are also more volatile, making them riskier than other asset classes. A higher allocation to stocks is appropriate for investors with a longer time horizon and higher risk tolerance.

Bonds: Bonds are fixed-income securities that provide regular interest payments. They are generally considered safer than stocks but offer lower returns. Bonds can help balance the volatility of stocks and provide stability in your portfolio.

Cash and cash equivalents: Cash investments, such as savings accounts and certificates of deposit (CDs), offer the least risk but also the lowest returns. These assets provide liquidity and protect your capital, making them suitable for short-term goals or as a cushion in a diversified portfolio.

Consider Alternative Investments

In addition to the traditional asset classes, some investors include alternative investments, such as real estate, commodities, or private equity, to further diversify their portfolios. While these assets can provide additional growth opportunities, they often come with higher risk and less liquidity, so they should only make up a small portion of a well-balanced portfolio.

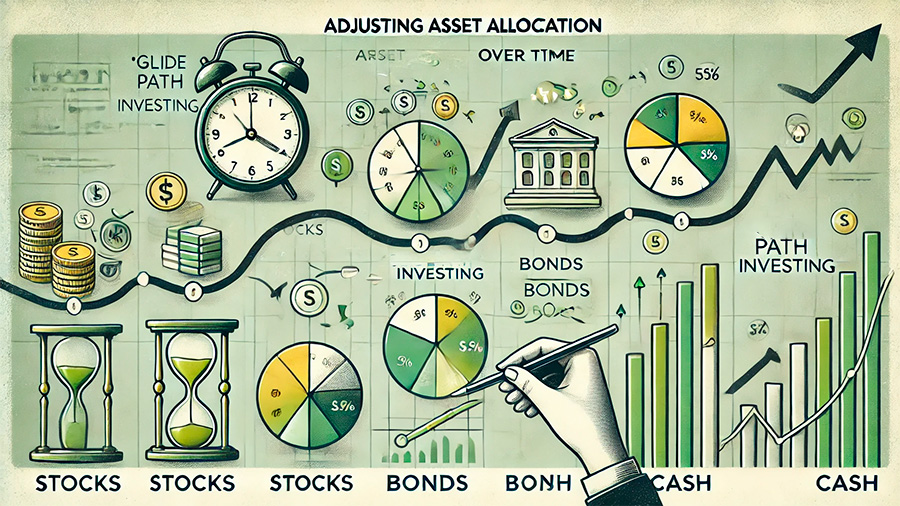

Step 3: Adjust Your Asset Allocation Over Time

Asset allocation is not a one-size-fits-all strategy, and it’s important to adjust your allocation as your financial situation changes. Over time, your risk tolerance may evolve, or you may be nearing a financial goal, which requires shifting to a more conservative allocation to protect your investments.

For example, as you approach retirement, you may want to reduce your exposure to stocks and increase your holdings in bonds or cash to preserve your capital and minimize the impact of market volatility. This process of adjusting your asset allocation over time is known as “glide path investing” and is commonly used in retirement planning.

Rebalancing Your Portfolio

In addition to adjusting your allocation based on life changes, you should also periodically rebalance your portfolio to ensure that your asset allocation remains aligned with your goals. Over time, certain assets may outperform others, causing your portfolio to drift from its intended allocation. For instance, if stocks perform well, they may take up a larger percentage of your portfolio than originally intended, increasing your overall risk.

Rebalancing involves selling assets that have grown beyond your target allocation and buying those that have underperformed, bringing your portfolio back into balance. This disciplined approach helps manage risk and keeps your investment strategy aligned with your financial goals.

Step 4: Avoid Emotional Investing

One of the biggest challenges investors face is resisting the urge to make emotional decisions, especially during periods of market volatility. Market downturns can tempt investors to sell off their stocks in a panic, while bull markets may encourage risky, impulsive buying. Both of these behaviors can lead to poor long-term results.

By sticking to your asset allocation strategy, you can avoid making reactionary decisions that could harm your portfolio. Remember that asset allocation is designed to help you weather market fluctuations, so trust the process and maintain discipline, even during turbulent times.

Conclusion

Building a resilient investment portfolio through asset allocation is key to managing risk and achieving long-term financial success. By assessing your risk tolerance, diversifying across asset classes, adjusting your allocation over time, and avoiding emotional investing, you can create a balanced portfolio that withstands market fluctuations. With a thoughtful asset allocation strategy, you’ll be well-positioned to grow your wealth while minimizing risk.